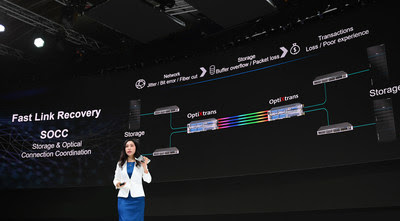

SINGAPORE, July 25, 2022 /PRNewswire/ — Recently, at the Huawei Intelligent Finance Summit 2022, Huawei released the industry’s first Storage-Optical Connection Coordination (SOCC) solution. This solution leverages the advantages of storage devices and optical transmission products to prevent financial transaction failures caused by network jitter, ensuring stable and reliable financial transactions.

The transaction link latency has a direct impact on customer experience. For this reason, financial regulatory authorities have exacting requirements on the transaction link latency and transaction success rate.

To reduce the impact of network jitter on financial transactions, Huawei’s SOCC solution enables direct handshakes through the SOCC channel between the industry-leading financial DCI optical transmission device OptiXtrans DC908 and all-flash storage OceanStor Dorado. In this solution, the optical network is used to detect link faults. When the link jitter exceeds the threshold, OptiXtrans DC908 notifies OceanStor Dorado to switch I/O channels within 2 seconds (down from the previous 120 seconds), greatly slashing the exception duration of financial transactions and ensuring zero financial transaction failure.

In addition, Huawei SOCC solution optimizes the optical link switching time from 50 ms to 5 ms to greatly reduce frame freezes of digital financial services caused by network faults. With innovative SOCC technology, Huawei optimizes the protection performance from the aspects of storage I/O links and optical links, thereby ensuring higher network reliability.

Huawei SOCC solution is designed for the financial industry to solve service loss caused by link switching and ensure the stable financial transactions. With leading innovative technologies and capabilities, Huawei will continue to build excellent products and solutions for the financial industry and enable green, digital, and smart finance.

About Huawei Intelligent Finance Summit

Huawei Intelligent Finance Summit (HiFS) is Huawei’s annual flagship event for the global financial industry. HiFS 2022 ran from July 20 to 22 in Singapore. With the theme of “Shaping Smarter, Greener Finance”, HiFS 2022 brought together leading figures, KOLs, academic experts, and innovative practitioners in the global financial industry to discuss how to shape green and digital finance in light of the future development trend of the financial industry. For more information, please visit: https://e.huawei.com/en/